Gráinne Gilmore is Director of Research and Insight at Cluttons, the property consultancy, examining all aspects of residential and commercial property markets, as well as infrastructure. Before this she held positions at Zoopla as Head of Research and at Knight Frank where she was Head of UK Residential Research, leading the team and producing insights on all aspects of UK sales, lettings, residential development and the specialist BTR, student and later living housing sectors.

Gráinne started her career at The Times, where she spent 10 years as a finance and economics journalist.

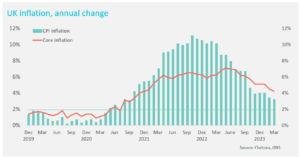

The economic mood music has been improving steadily in recent months. The latest data shows that CPI inflation dipped sharply to 3.2% in March, down from 10.1% in March a year ago, and the lowest rate since September 2021. This is raising the prospect of base rate cuts in the summer. This would be the first downward movement in central bank rates in more than four years.

Falling inflation, and the anticipation of base rate cuts has been enough to spur a downward movement in mortgage rates since late last year, benefitting first-time buyers and those looking to re-mortgage or move home. Stickier than expected wage data caused a slight bounce back last month, but mortgage rates will likely fall further as we move through 2024, expanding the budgets of those looking to buy a home.

The housing market was constrained last year by the continual increases in base rates, and uncertainty around where the peak in rates would be, alongside very high inflation. While these more challenging economic conditions might have been expected to take a toll on house prices, in fact the total decline in pricing was relatively modest, with the annual falls in average UK prices at -5% in Q3 last year. Home values are already rising again on average, although there will be some areas that are racing ahead or lagging this average trend.

Where the impact of rising costs was felt most last year was activity in the market, with total UK sales numbers falling to around 1 million, down from 1.25 million in 2022 and 1.5 million in 2021 – although these numbers were boosted by activity during the pandemic which spurred many households to move around the country.

Initial indications signal that transactions will rise this year, and we estimate they could move back towards longer term trend of around 1.2 million sales. Data from Zoopla suggests that the number of sales agreed in the four weeks to mid-February was higher in every part of the country than during the same period last year. Moving back earlier in the sales process, mortgage approvals also rose sharply in February, with the number of loans approved for home purchase rising to the highest level since summer last year.

Even as activity picks up, pricing will remain key, however. Mortgage rates will fall further, but they are set to remain well above the ultra-low levels last seen in 2021 in the longer-term, and pricing will have to reflect this.

The rental market remains strong with ongoing demand especially in city centres. However, the gap that opened up between high demand and limited supply which opened up in 2022 and into last year, which pushed rents sharply upwards, is starting to narrow. Demand will remain robust this year, but the narrowing supply gap, coupled with affordability constraints, will mean rental growth is more moderate this year than in the last 24 months. We expect average UK rental growth to be around 4% this year.