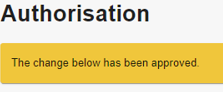

How do I attach a document via secure messaging?

When you send us a message and need to attach supporting documents, for instance if you want to update your name, there will be an option just underneath the message box where you can find the file on your computer and attach it:

Please note that only PDF documents up to 6MB are accepted.

How do I change my contact preferences?

You can change which methods of contact you prefer via online banking. Once you have logged in, please select ‘My Details’ then ‘Preferences’. You will then have the option of selecting which methods you want for both general contact and marketing communications.

I have forgotten both my username and password. What should I do?

If you have forgotten both your username and password, please contact us on 020 3862 1268 between 9am and 5pm Monday to Friday, where we will be happy to assist you further.

I get a message saying you are not able to find my details. Why is this?

This could be for a number of reasons:

• We do not hold one or more of the required details (for example, we may only hold your landline number)

• We do not hold your up-to-date details (for example, if you have changed your email address)

• You have entered some of your details differently to those provided in your application

• The account number you have entered is not an active account with United Trust Bank

• You have not entered the date of birth in the correct format (ddmmyyyy)

When you see this message, you will be given a unique code on screen. Please call us on 020 3862 1268 between 9am and 5pm Monday to Friday to provide us with this code, and we will be able to support you further and get you registered.

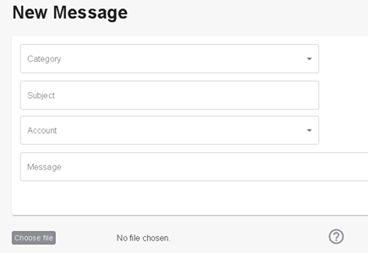

How do I request a withdrawal or place notice on my account(s)?

Should you wish to withdraw funds from a notice account, you will need to consider the notice period on your account prior to submitting your request. Unless under exceptional circumstances, and entirely at UTB’s discretion, you must see out your notice period before the funds are sent to your nominated bank account.

To place notice, simply login to your account, select the relevant account and then choose the option ‘Make a Withdrawal’. You then have the option to choose whether it is a partial withdrawal or a full closure. Please note, to keep the account open you must have a balance of at least £5,000 left after the withdrawal.

See below for an online banking withdrawal example:

If you hold funds in a Call Account, you will be able to make a request for an immediate withdrawal to your nominated bank account, in line with our terms and conditions. Please either send us a secure message or call us on 020 7190 5599 between 9am and 5pm Monday to Friday.

I am not receiving a password reset or username reminder email. What should I do?

Please check that the details you are entering are correct, as you will only receive the email if the information matches what we hold for you. If you do not receive an email from us, please call us on 020 3862 1268 between 9am and 5pm Monday to Friday as we may need to reset your details instead.

Can I change my memorable word?

To change your memorable word, select ‘My Details’ and ‘Online Security’ from the top menus within online banking. You will be able to enter your new memorable word and will be prompted to re-enter it to confirm that the memorable words match. Once you are happy, select ‘Change memorable word’ and this will carry out your request.

I was unable to provide instruction on some of my accounts. Why?

At present, you will not be able to provide us with your maturity instructions if your funds are held in any of these account types:

Easy Access Account

ISA Call Account

Should you wish to provide us with a reinvestment instruction for one of these accounts, please open the new desired account via the ‘New Application’ option on your online banking and then send us a secure message to request the transfer. Alternatively, you can call us on 020 7190 5599 between 9am and 5pm Monday to Friday.

If you would like to withdraw funds from an easy access account you can do so directly via online banking, and we will send the funds to your nominated bank account via faster payment. For withdrawal timescales, please refer to Section E of our Terms and Conditions.

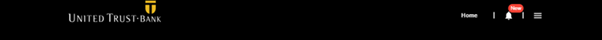

How do I check or reject an action on my joint account?

If a joint account requires more than one signatory to complete an instruction, both parties will be required to authorise any amendments made via online banking.

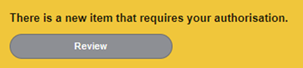

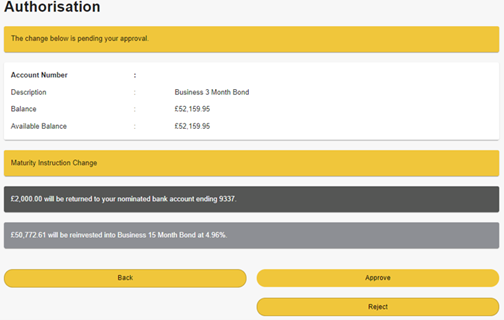

Either party will be able to log in to online banking, if registered, and submit a request. This will prompt a requirement for the other party to approve, and the request will be held as ‘Pending’. A request will not be fully processed until the joint party logs in and approves it via the ‘Authorisation’ menu at the top. They can also head straight to the request by following the notification bell at the top of the page:

The joint party will be able to ‘Approve’ or ‘Reject’ the request:

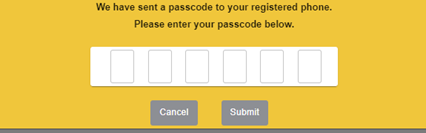

Once the ‘Approve’ option has been selected this will prompt a Two Factor Authentication (2FA) response:

You will then see that the request has been approved: